Investment Objectives

Investment Objectives

UNDERSTANDING THE INVESTMENT OBJECTIVES

No single investment guarantees both the greatest returns and absolute protection from all risk. SmartPlan recognizes that your two basic goals are capital growth and preservation of capital. The following investment objectives below allow you to choose how much emphasis you want placed on growth and how much on preservation of capital by reducing the risk of capital loss. Each involves a different approach to managing your funds in order to reach your goal.

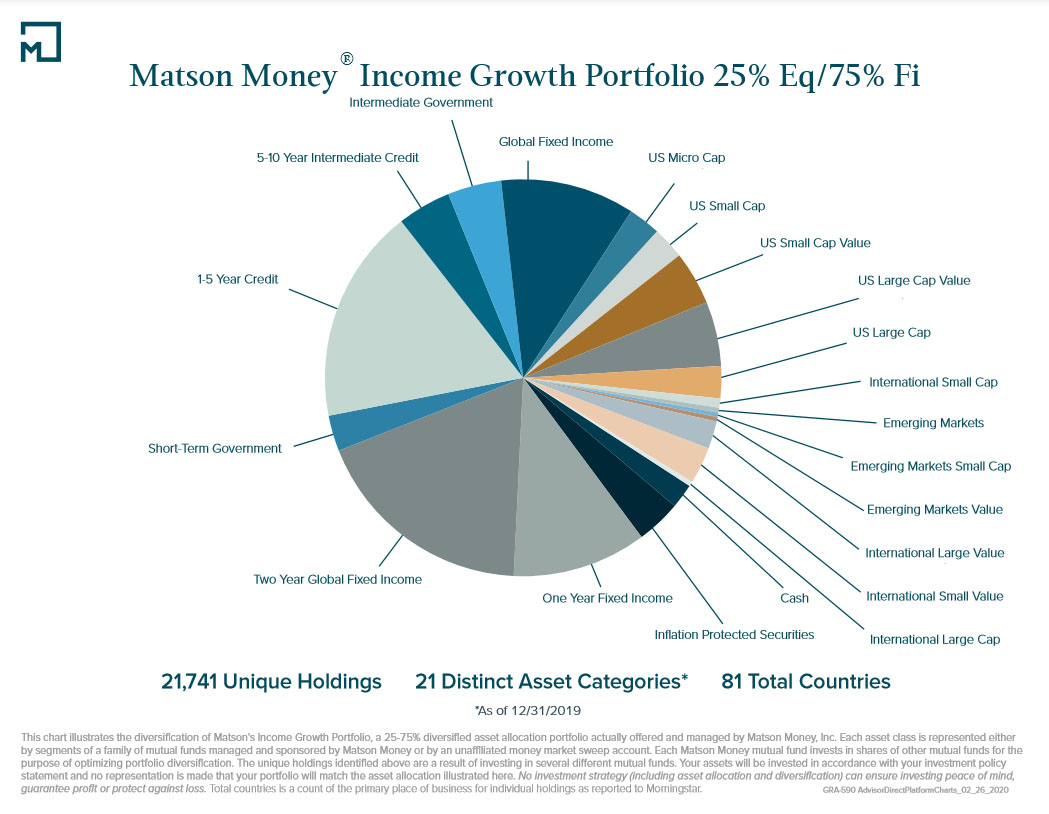

Income and Growth (25% Equities / 75% Fixed Income)

Time Horizon: Less than 3 Years Risk Tolerance: Low Risk

The objective of this Asset Allocation is to minimize capital fluctuations while attempting to deliver a rate of return in excess of inflation as measured by the consumer price index (C.P.I.). The choice of this objective indicates a realization that the Account Owner’s portfolio must stay ahead of inflation to make any real gains.

While this approach will provide the least amount of capital fluctuation, the possibility of negative returns is not eliminated, only reduced. This approach does imply a substantial reduction of capital growth when compared to the stock market. This objective fits with the time horizon of less than three years.

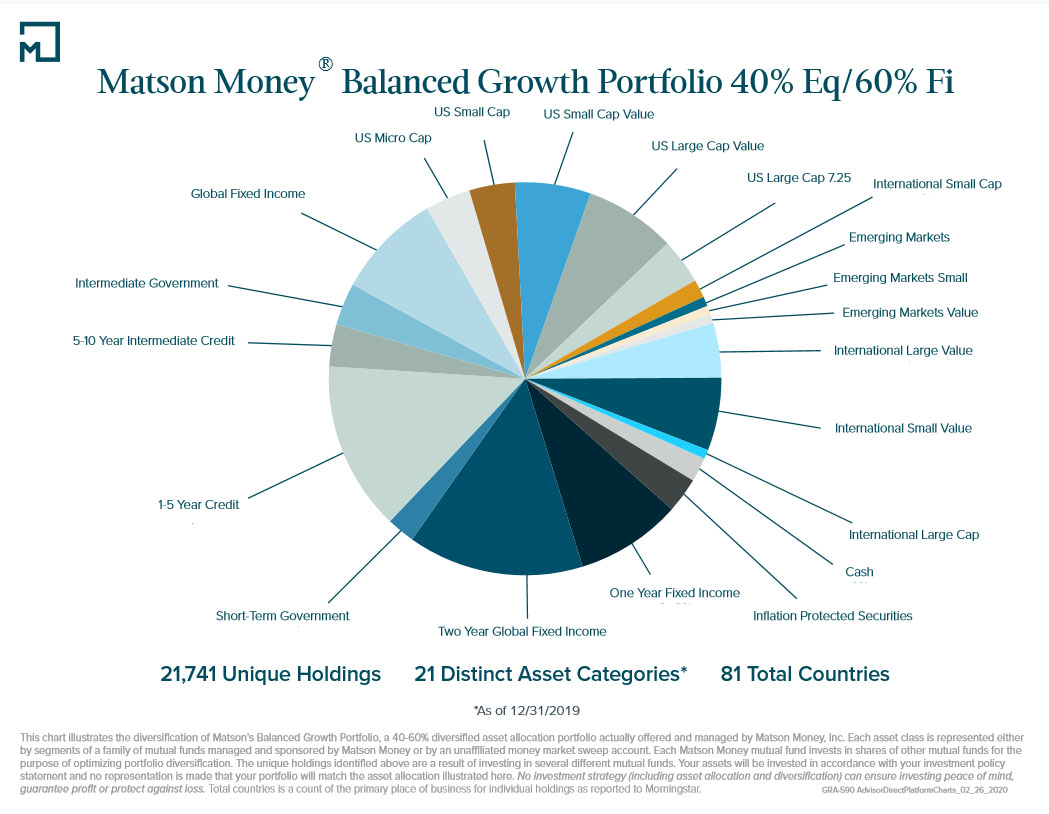

Balanced Growth (40% Equities / 60% Fixed Income)

This asset allocation has two purposes: to preserve capital and to obtain capital growth. This objective indicates a need for a balance between capital preservation and long-term growth and will result in SmartPlan choosing more stable and less volatile investment strategies than with the Long-Term Growth investment objective.

Inherent in this position is that the earning potential of your investment will be less than in the objective 5, but this objective should also be less volatile over time while earning a premium above short-term rates. The risk of capital loss and negative returns cannot be eliminated, but with this choice your portfolio will be subjected to less capital risk than is characteristic of the stock market.

While the rate of return cannot be compared to the stock market, the investment manager will be expected to exceed the returns from Money Market Funds and three-month Treasury Bills. To achieve these returns, no less than a full-market cycle of three to five years is required.

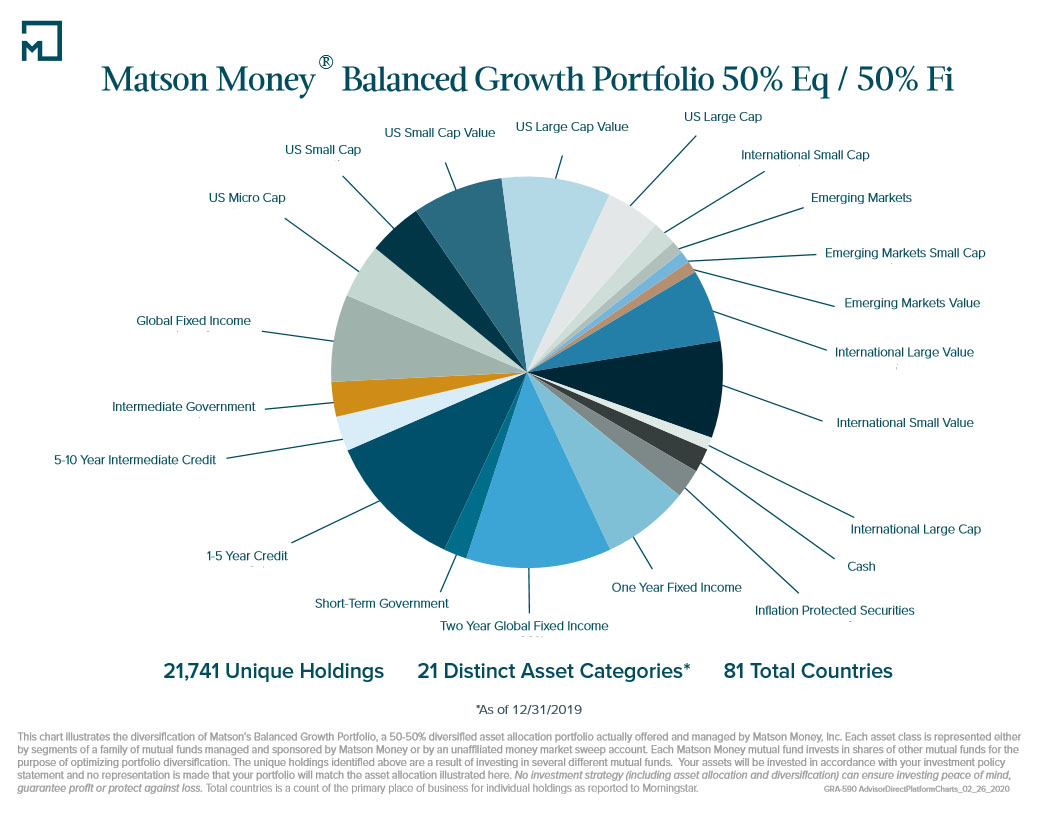

Balanced Growth (50% Equities / 50% Fixed Income)

Time Horizon: Three to Five Years Risk Tolerance: Moderate Risk

This objective has two purposes: to preserve capital and to obtain capital growth. This objective indicates a need for a balance between capital preservation and long-term growth, and will result in SmartPlan choosing more stable and less volatile investment strategies than with the Long-Term Growth investment objective.

Inherent in this position is that the earning potential of your investment will be less than in the objective 4, but this objective should also be less volatile over time while earning a premium above short-term rates. The risk of capital loss and negative returns cannot be eliminated, but with this choice your portfolio will be subjected to less capital risk than is characteristic of the stock market.

While the rate of return cannot be compared to the stock market, the investment manager will be expected to exceed the returns from Money Market Funds and three-month Treasury Bills. To achieve these returns, no less than a full-market cycle of three to five years is required.

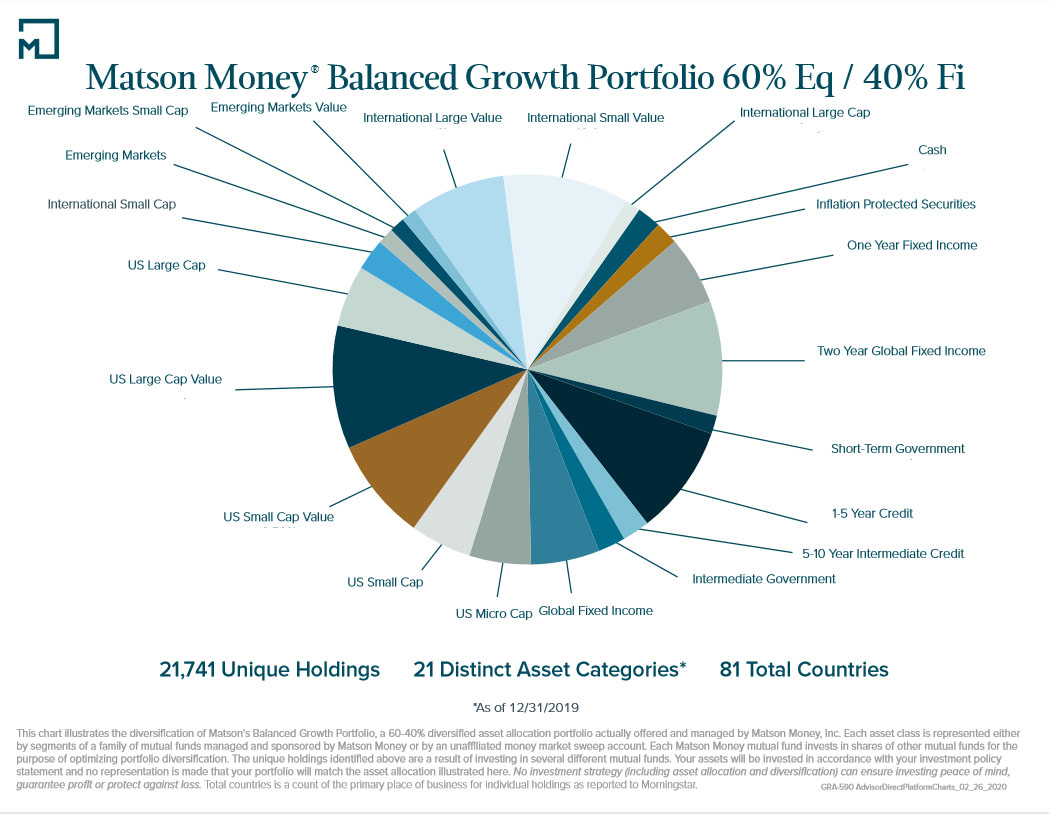

Balanced Growth (60% Equities / 40% Fixed Income)

This objective has two purposes: to preserve capital and to obtain capital growth. This objective indicates a need for a balance between capital preservation and long-term growth, and will result in SmartPlan choosing more stable and less volatile investment strategies than with the Long-Term Growth investment objective.

Inherent in this position is that the earning potential of your investment will be less than in the objectives 3 or 4, but this objective should also be less volatile over time while earning a premium above short-term rates. The risk of capital loss and negative returns cannot be eliminated, but with this choice your portfolio will be subjected to less capital risk than is characteristic of the stock market.

While the rate of return cannot be compared to the stock market, the investment manager will be expected to exceed the returns from Money Market Funds and three-month Treasury Bills. To achieve these returns, no less than a full-market cycle of three to five years is required.

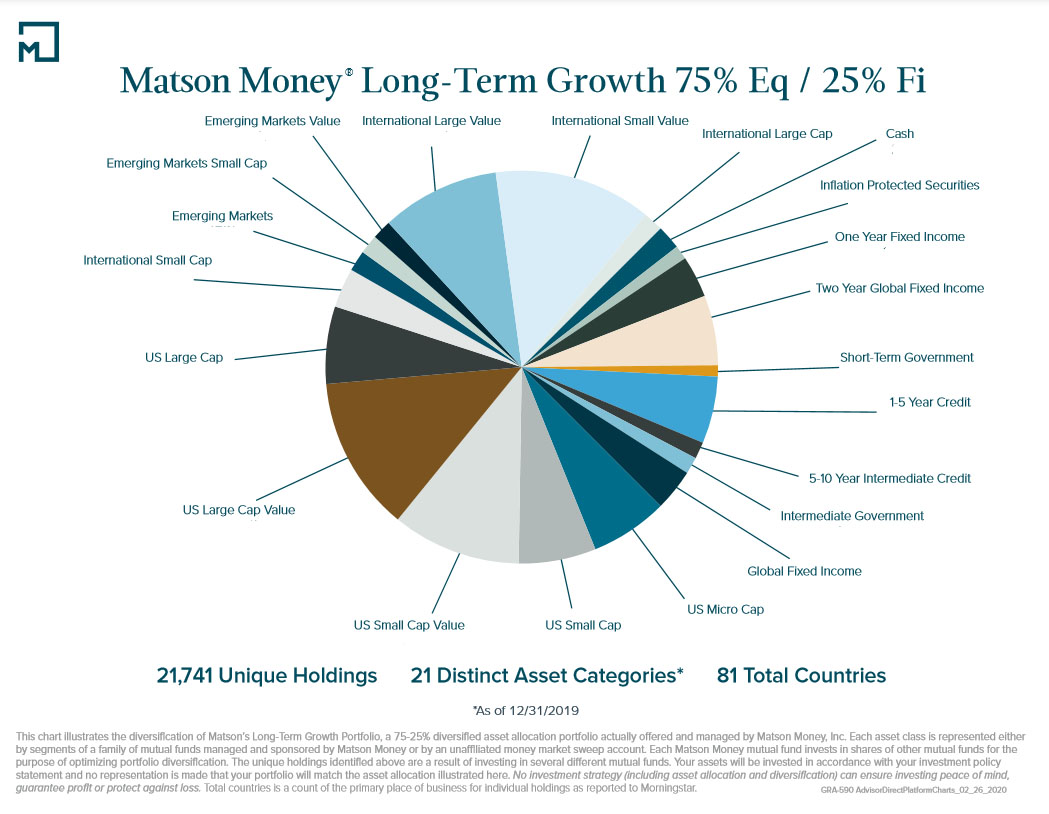

Long-Term Growth (75% Equities / 25% Fixed Income)

Time Horizon: Six to Nine Years Risk Tolerance: Medium to High Risk

This objective provides a reasonably high rate of growth without the full degree of risk usually found in the stock market. The primary goal is long-term capital growth while the secondary goal is preservation of capital. In order to achieve long-term capital growth, greater volatility, including the risk of negative returns, will be encountered than with the choice of prior Objectives.

This objective does not, however, expose investors to the full capital risk of the stock market. Returns will not compare with the stock market on a year to year basis, but should be less volatile than stock market returns. Six to nine years may be required to achieve this objective. Annual withdrawals may not be appropriate with this objective due to the short-term volatility of the stock market.

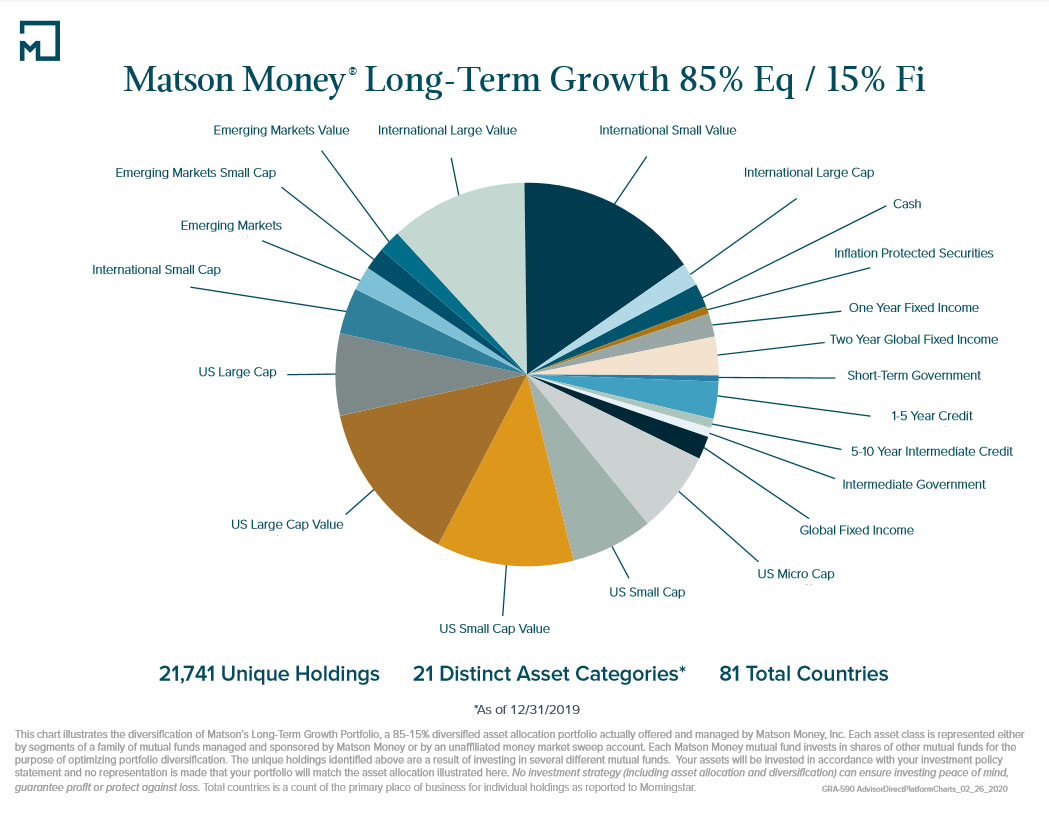

Long-Term Growth (85% Equities / 15% Fixed Income)

This objective provides a reasonably high rate of growth without the full degree of risk usually found in the stock market. The primary goal is long-term capital growth while the secondary goal is preservation of capital. In order to achieve long-term capital growth, greater volatility, including the risk of negative returns, will be encountered than with the choice of prior Objectives.

This objective does not, however, expose investors to the full capital risk of the stock market. Returns will not compare with the stock market on a year to year basis, but should be less volatile than stock market returns. Six to nine years may be required to achieve this objective. Annual withdrawals may not be appropriate with this objective due to the short-term volatility of the stock market

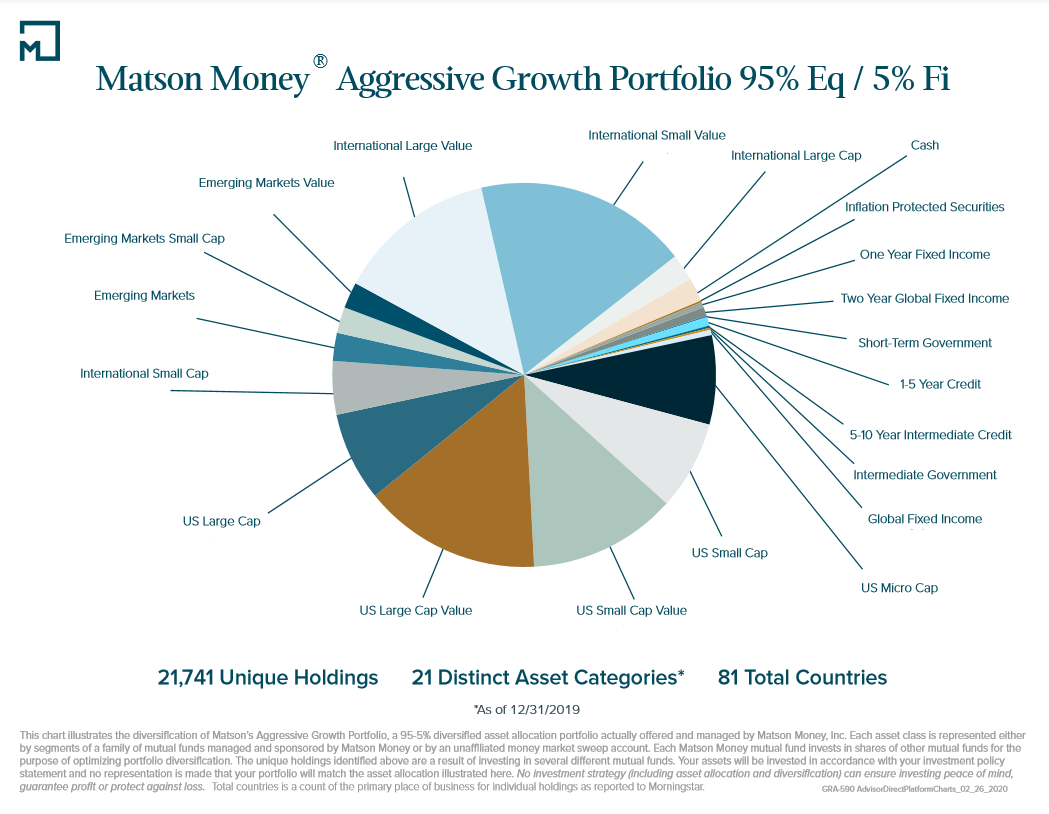

Aggressive Growth (95% Equities / 5% Fixed Income)

Time Horizon: Over Ten Years Risk Tolerance: High Risk

Since capital growth is the only goal in this asset allocation, the investor must also accept the high degree of risk inherent in the stock market. This asset allocation provides the greatest growth potential of the seven and exposes the Account Owner to the greatest degree of volatility.

SmartPlan will focus the Account Owner’s portfolio in equity funds to help produce better long-term returns. This is a long-term investment strategy of at least ten years. Annual withdrawals may not be appropriate with this objective due to the short-term volatility of the stock market.

Your Investor Coach can help you determine which investment objective is best for you.

Past performance is no guarantee of future results. These simulated returns do no reflect any portfolio managed by Matson Money Inc. This chart illustrates back-tested returns based on historical data from various indices representing each asset class of the hypothetical portfolio. It includes reinvestment of dividends and capital gains, and deduction of a 2% management fee. The endnotes contain more information on the inherent limitations of back-tested performance and the representative indices used to generate the hypothetical portfolio. No representation is made that your investments will achieve results similar to those shown.