Global Investment Performance Standards

Global Investment Performance Standards

What is a GIPS audit?

GIPS is ethical standards to be used by investment managers for creating performance presentations that ensure fair representation and full disclosure of investment performance results. Global Investment Performance Standards were created by the Chartered Financial Analyst Institute and governed by the GIPS Executive Committee.

The GIPS standards are voluntary and managers that want to implement the standard in to their firm must meet the compliance and verification to include the following processes and procedures: Fundamentals of Compliance, Data Input, Calculation Methodology, Composite Construction, Disclosures, and Presentation and Reporting. The overall desired outcome is allow investors to compare apples to apples.

Source: Investorpedia.com

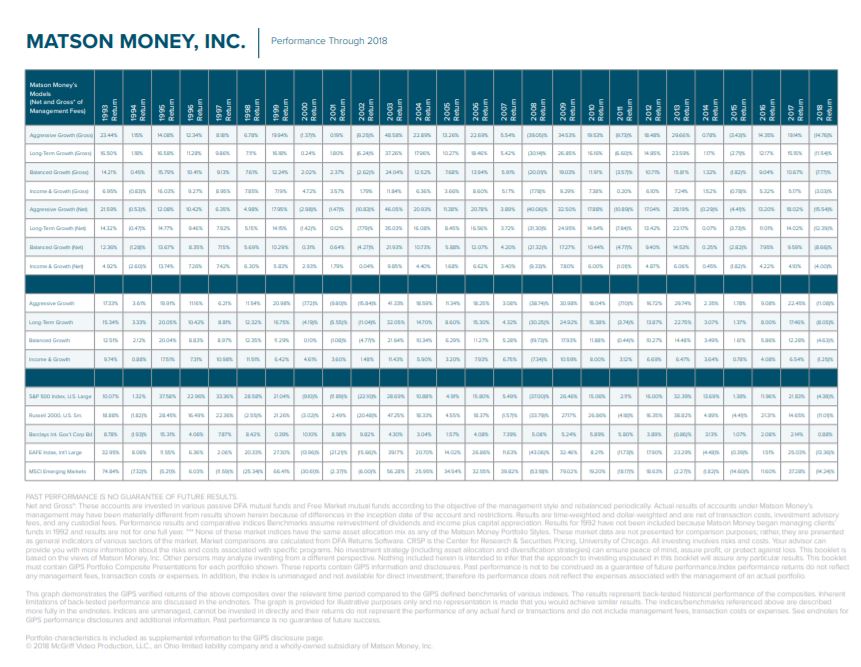

View the PDF Models Performance through 2018.

View Prospectus Here

Question: Do all firms have to abide by GIPS?

Answer: No

Question: Why is GIPS important?

Answer: For investors the benefit is that the information presented to them is transparent. This avoids a firms ability to “cherry pick” funds and accounts that have had the best performance, or choosing a selective time period to make their over all returns look better than they actually are.

You can read more about GIPS here.

Below are the various Performance Examination Reports that meet the GIPS standard, these include all clients actual returns and returns after fees.

- MM 25% Equity/75% Fixed Income – Income Growth GIPS Composite 2019 Annual Report

- MM 50% Equity/50% Fixed Income – Balanced Growth GIPS Composite 2019 Annual Report

- MM 75% Equity/25% Fixed Income – Long Term Growth GIPS Composite 2019 Annual Report

- MM 95% Equity/5% Fixed Income – Aggressive Growth GIPS Composite 2019 Annual Report